Tokenomics

SIKKA and GIKKA Tokens

Sikka utilizes a two-token system: SIKKA and GIKKA.

- SIKKA is the USD-pegged stable asset used to pay out loans on the Sikka Protocol. At any time it can be redeemed against the underlying MATIC collateral at face value.

- GIKKA is the secondary token issued by Sikka. It captures the fee revenue that is generated by the system and incentivizes early adopters and SIKKA holders. GIKKA token is the Sikka Protocol's governance token, managing Sikka Revenue Pool distribution and GIKKA token rewards.

Token Functions

The GIKKA token will fulfil the following main functions:

- As a utility token to boost SIKKA rewards for liquidity pool staking.

- As a governance token on Sikka, governing the stability of the protocol and changes.

- As an incentive for early adopters, providing revenue opportunities.

The SIKKA token will fulfil the following main function:

- To provide a means to gain GIKKA, as it's minted for users when they borrow SIKKA.

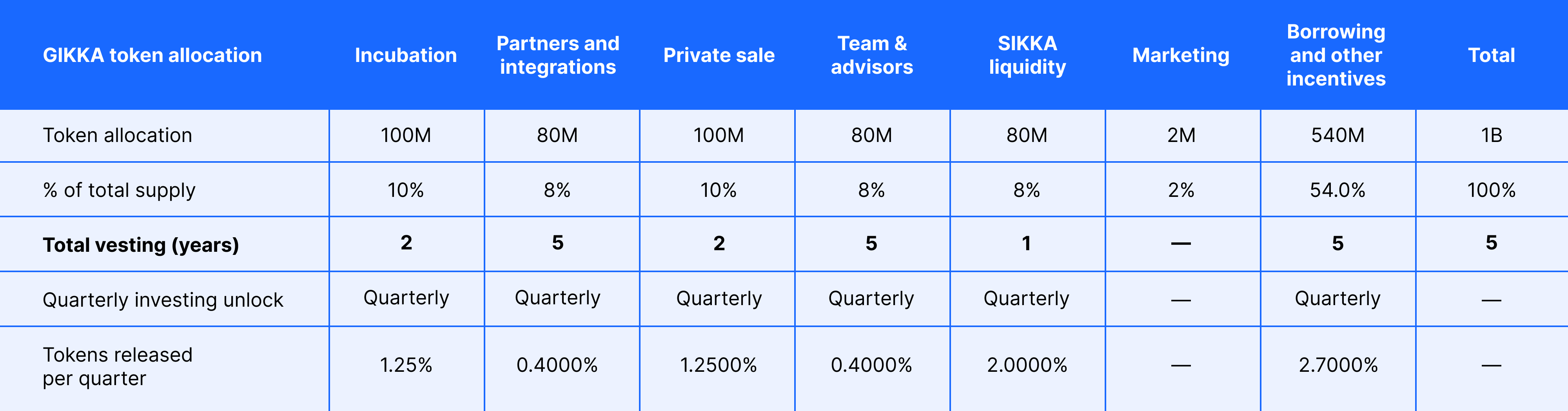

Tokens Allocation

GIKKA is planned to be distributed the following way:

- 54% will be allocated to borrower incentives and other incentives.

- 10% will be allocated to a private sale.

- 10% will be incubated.

- 8% will be allocated to Polygon Studio/Launchpad.

- 8% will be allocated to the team and advisors.

- 8% will be allocated to Sikka staking and Liquidity Pool rewards.

- 2% will be allocated to the marketing team.

For more detail, see the table below showing the allocation and initial distribution scheme: